How to never be financially vulnerable again

Meet the Resilience Fund. Better than any emergency fund

It started with hearing the squirrels running through our walls. Crap, that’s going to cost money.

Next, it was noticing that our water heater was 10 years past its prime and likely to fail at any moment. If we don’t fix this now, we’ll be forced to fix it at the worst time and at the worst rate. Better not roll the dice.

Then it was the electrician, while installing the water heater, informed us that our outdoor electrical panel had degraded into a fire hazard. You can’t unhear those words. Time to pull out the checkbook.

The next week it was the dental procedure that wasn’t covered by insurance and that couldn’t wait. Teeth have a way of making them your top priority.

Finally there was the kicker. All of this financial misfortune a) pounced over a two month span, and b) started right after getting punched in the gut by my fifth back-to-back layoff.

However ominous all of this sounds, however, I didn’t break a sweat and my job hunting timeline didn’t shrink by a single day. I was ready for all of it.

But things weren’t always like this.

Flying without a parachute

For most of my adult life, any one of these expenses alone would have ruined me.

I was totally ignorant to just how precarious my financial situation was, but perhaps worse than that, I actually thought I was killing it.

Looking back, it’s easy to see how I could have been so wrong for so long. While I always had some savings, I was woefully short of what I actually needed.

As I grew older and life got more complicated (i.e. more expensive) the tiny “emergency fund” that was never enough to begin with, quickly diminished into an ornamental line item in my budget that couldn’t even pay for half a typical car repair.

I was too busy channeling my income to more important ‘adult’ concerns like paying off debt, contributing to my 401k, and opening a brokerage account.

I was obsessed with compound interest and placed a much higher value on my future than on the present.

Waking up

This is what woke me up:

When my car broke down, I’d have to pay with a credit card because I didn’t have the cash, and when the bill came, I couldn’t cover it in full.

When the dog started getting old, increasingly regular vet bills also had to go on the credit card. All of a sudden, I had a balance of high interest debt again, and it was slowly creeping up.

I didn’t have the money to cover a hospital visit after I switched to a high-deductible health plan. As a healthy young man, I foolishly thought I’d never have to cough up the $4,000 toll that must first be paid before insurance starts kicking in. Spoiler alert: I was wrong.

The prior holiday bonus I got didn’t seem to help with any of the above. Where did that money go anyway? Oh yeah, it went to a vacation to Panama that, given my ignorance, I was sure I could afford.

Once is an aberration, twice is a coincidence, thrice is a trend, and beyond that you’re in denial.

I was in denial.

Despite all of these signals to the contrary, I was still able to convince myself that investing and paying off debts was the right thing to do with my money. That all changed when I experienced my first layoff.

You can’t invest or pay down debt without an income, and now that I couldn’t do either, I was finally able to see my present situation for the dumpster fire it really was. I had no savings, no job, and I had never been this vulnerable.

Security must come first

What I would eventually come to realize was that I was working out of order. Rather taking a crawl, walk, run approach to my finances, I went from crawl to sprint and never learned how to walk.

I placed supreme value on harnessing compound interest to build my future and treated present day security as an afterthought.

Perhaps the one-two punch of hubris and inexperience that afflicts all young men made me think that I didn’t need security because my luck would never run out.

Probably.

But what would have really helped is if I had someone, a few steps ahead of me, grab me by the shoulders and tell me how poor my decision making was.

They’d show how my efforts to build a rosy-but-hypothetical tomorrow had me walking through a very real minefield today.

Here’s what that person would say.

You can do it all, just not all at once

First and foremost, you need to have savings. Let me repeat that.

The number one most important thing you must do with your money is build savings.

Life is volatile, and everyone’s luck eventually runs out. Until you have savings, doing anything else with your money is counterproductive:

Progress made paying off high interest debt gets wiped away if you have to go back into debt to handle a curveball that life throws your way.

The single worst thing you can do to a compounding asset like your retirement or stock portfolio is withdraw from it before it’s had a chance to grow. That’s exactly what you’re forced to do when one of those fastballs finds you without savings. That, or you end up “fixing” your problems with debt.

The most urgent kind of savings to build is your Resilience Fund. These are savings dedicated to handling specific one-time expenses that may or may not come.

Stocking your Resilience Fund is your most urgent priority.

Don’t worry about doing anything else with your money until this is done.

The key to building your Resilience Fund is to have a plan that clearly lays out a timeline and is built for speed.

Unlike a generic emergency fund, which is just some arbitrary amount of cash you’ll eventually get to saving, each dollar in the Resilience fund has a purpose and target date.

Here’s how to build it.

Step 1: Name your threats

To get started, you need to make a list of all the potential expenses that you’re currently vulnerable to. Here’s a non-exhaustive checklist to help you brainstorm:

Insurance deductibles

Key equipment or appliances you depend on

Medical expenses not covered by insurance

Pet expenses

Specific car repairs and maintenance

Specific home repairs

This is a specific list of all threats that could derail your financial life. This is your specific minefield.

Step 2: Size them up

Next, you’ll want to put a dollar amount on each of these threats. This is the amount of money you’ll want to have in hand if and when the threat strikes.

If you have a $500 deductible for your car insurance, then you’ll assign $500 to this threat.

If you have a washing machine that might need to be replaced soon, research the cost of a replacement and use that figure.

In the case of car maintenance, use a conservative average for how much it costs anytime the check engine light comes on.

Step 3: Sort them

Now that each item has a dollar amount, sort them all from smallest to largest and add them to your budget as savings categories. My budgeting app of choice YNAB, and YNABers commonly describe these categories as Rainy Day funds.

This is now your Resilience Fund ‘hit list’. You’ll use your budget to direct and track your income to each of these categories, one at time, and in order.

Smallest to largest matters because your psychology is of paramount importance. You need to have a list of quick wins to build momentum and boost your savings self confidence.

Step 4: Redistribute your savings

Take any general savings you have and distribute them to your new hit list. You’ll likely fill the first few instantly, which is a great hit of dopamine to get started.

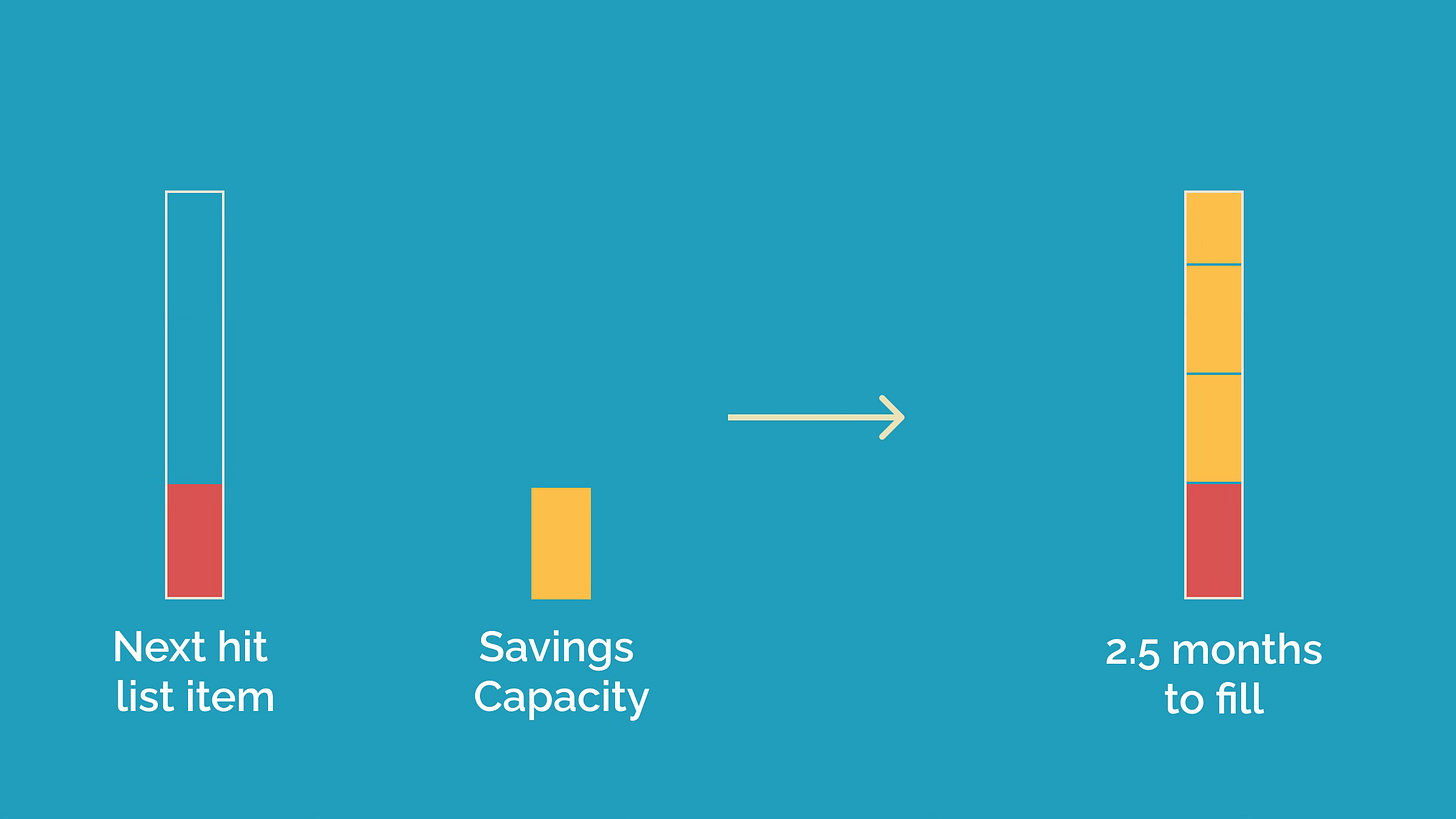

Now identify the next item on the list that’s not full. That’s your target.

Every last dollar of excess income must go to filling this category until it’s full. Then, move on to the next category until that one’s full. Repeat with each category until you’ve fully stocked your Resilience Fund.

Step 5: Figure out the timeline

Remember that the goal is to build this savings as quickly as possible. The sooner you get this done, the sooner you can graduate to the sexy stuff like paying off debts, going on vacation, and playing in the stock market.

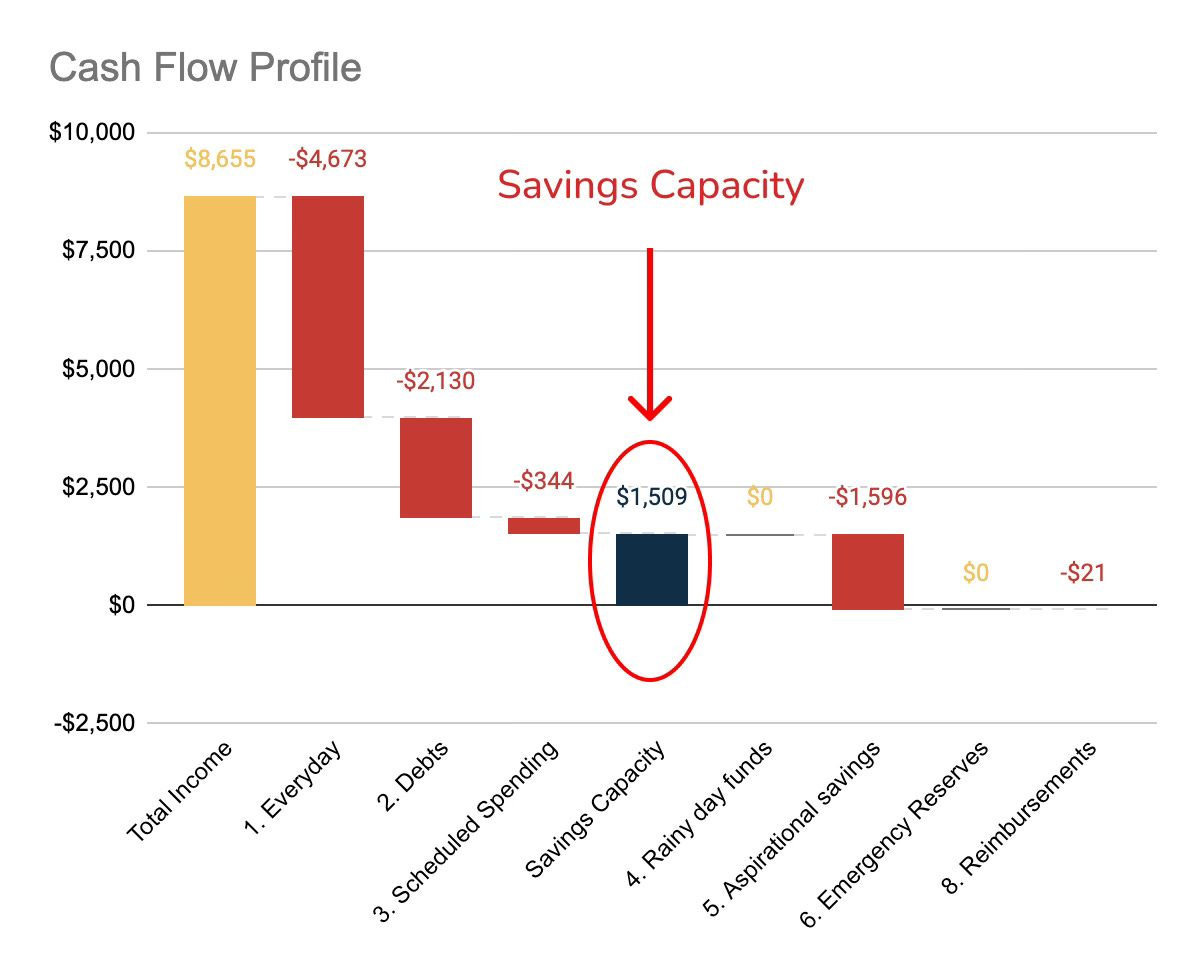

To get a sense for how long this will take, you need to know your Savings Capacity.

This is your monthly income minus

Everyday Expenses - common monthly and weekly expenses (housing, groceries, clothing, utilities)

Debt payments - debt payments (credit cards, mortgages, student loans)

Scheduled Expenses - future expenses that you know the date for (quarterly insurance premiums, yearly credit card fees, semi annual subscription renewals)

Properly organizing your budget has a massive influence on your ability to read your finances and make sensible decisions. The categories above are part of the Standard Budget Category Groups described in this newsletter. I highly recommend using them.

Once you know your savings capacity, you can figure out how many months it’ll take to fill up your next savings hit list item. In the example below, it’ll take about two and a half months to fill the current hit list item before moving on to the next.

Why this works

This plan takes advantage of positive psychology to make hitting your savings goals a matter when and not if. By listing, sorting, and scheduling your savings goals, you get precise and specific.

This precision and clarity allows you to create realistic goals that you’ll want to keep yourself accountable to. Dragging your feet to save or getting lured into a large impulsive purchase by a sale stops happening because now you have a timeline that you don’t want to sacrifice.

As you neutralize each threat, you feel yourself becoming stronger. You find yourself happily reviewing your finances just to see how far you’ve come. You sleep better at night knowing that this is the best thing you can be doing with your money at this time.

Life is volatile, and we can never know how and when the universe will dole out the misfortune we’re exposed to. But you can prepare.

As long as you have a clear and precise plan that you understand and believe in, there’s no reason to ever be vulnerable again.

This is what I wish I knew 15 years ago.