Stop sabotaging your financial progress

How to actually achieve your savings goals (using a Pareto chart)

"You're not going to be able to run this race." These were the words my doctor said and that I had been dreading.

For the prior three months, I had been training for a marathon, and no part of life had been untouched. Suddenly all of the declined invitations, sacrificed weekends, and endless hours of icing and stretching were for nothing.

I had developed a merciless case of shin splints so bad that I was barely able to walk. There was absolutely no way I was going to be running 26.2 miles in two weeks, and the doctor and I both knew it.

He explained that I had been running too fast, too often, for too long, and that the pain in my legs came from not allowing myself to adequately recover.

I had been following a training plan suited for a more experienced runner, and my body couldn’t keep up with the damage I was piling on. After 10 weeks, my body had reached its limit.

A hard lesson learned

As much as I'd like to say I learned my lesson, I didn't. I'd have to forfeit this and another marathon before I finally crossed a finish line.

All the while, I was playing out a similar pattern of mistakes in my financial life. I was loading my budget with a needlessly aggressive plan to build savings and pay down debts that mirrored the self sabotage I was experiencing in my running.

In an ongoing effort to turn my finances around, I’d set aggressively low spending targets that forced me to live a life of extreme limitation. My motto was “If I just don’t have a life, my financial problems will go away fast.”

Just like with shin splints however, it amounted to withholding too much, too often, for too long, and not giving myself any kind of relief along the way.

While I might be able to stay in and read a book every weekend for a month, I couldn’t do it forever. Same with food and social activities. I’d eventually crack, throw my budget out the window, and ‘live a little.’

Then it would happen again. Then again. It was as if all the limitation and withholding would build up pressure that invited reckless spending as its inevitable release.

How we self sabotage

Our culture rewards fast results through suffering.

There are countless viral tweets and Youtube videos celebrating accelerated life transformations through masochistic principles like "no pain no gain" and "rise and grind."

We idolize the extreme lifestyles of Navy S.E.A.L.S., and we’re encouraged to embrace the pain of leg day. This perspective is often referred to as hustle culture, and it’s been popular for a while now.

Hustle culture’s implied message is that the more you struggle, the faster your results. The contrapositive also holds: If you’re not seeing results fast enough, it’s because you’re not struggling enough.

As a formerly big proponent of hustle culture, my shin splints and I were always looking for a way to get big results as fast as possible. For instance, I’d NEVER allow myself to walk during a training run. I thought it was soft and weak.

I took that same stupid view to improving my finances. I’d do whatever it took to see results quickly. The more extreme the better.

I found myself:

Slashing my spending overnight with no release valve to offset the misery

Bragging to my friends about how small I was living

Myopically celebrating sacrifice and obsessing over my savings ‘gains’

Shaking my head at people who were “doing it wrong” by not going all out like I was

Not only did my warped plans never work out, but with each failed attempt to "right the ship," I'd lose a bit more confidence in my ability to ever get myself into better financial shape.

Losing confidence is the first step in losing belief in your ability to change, and once you lose that, you lose hope in ever being able to improve your financial life.

You commit to failure the moment you stop believing in your ability to change

Changing my mindset

After having to sit out multiple marathons, I could see that my training approach (and perspective) was clearly not working, so I decided to make a change. Rather than trying to run as intensely as possible, I’d now just focus on feeling good.

That meant slowing down to find a pace I could comfortably maintain and, yes, walking. Making this change required me to check my ego and flex a new muscle, patience.

In a surprising twist, my overall running speed is the one thing that didn't really change. The new run-walk-run pace was actually about the same as the painful shuffle I’d always resort to after running injured for several weeks.

The speed was about the same, but my experience was night and day.

And wouldn’t you know it, the same solution found an analogue in my finances. Rather than trying to build savings and pay down debts as intensely as possible, what if I instead just focused on feeling good and being patient?

Sure, it would take longer, and maybe be less badass, but I’d actually get there.

The right pace

Luckily, when you have budget data, finding the right spending plan is a lot easier than the fuzzy art of figuring out the right running pace.

What makes it so easy is the use of a Pareto chart.

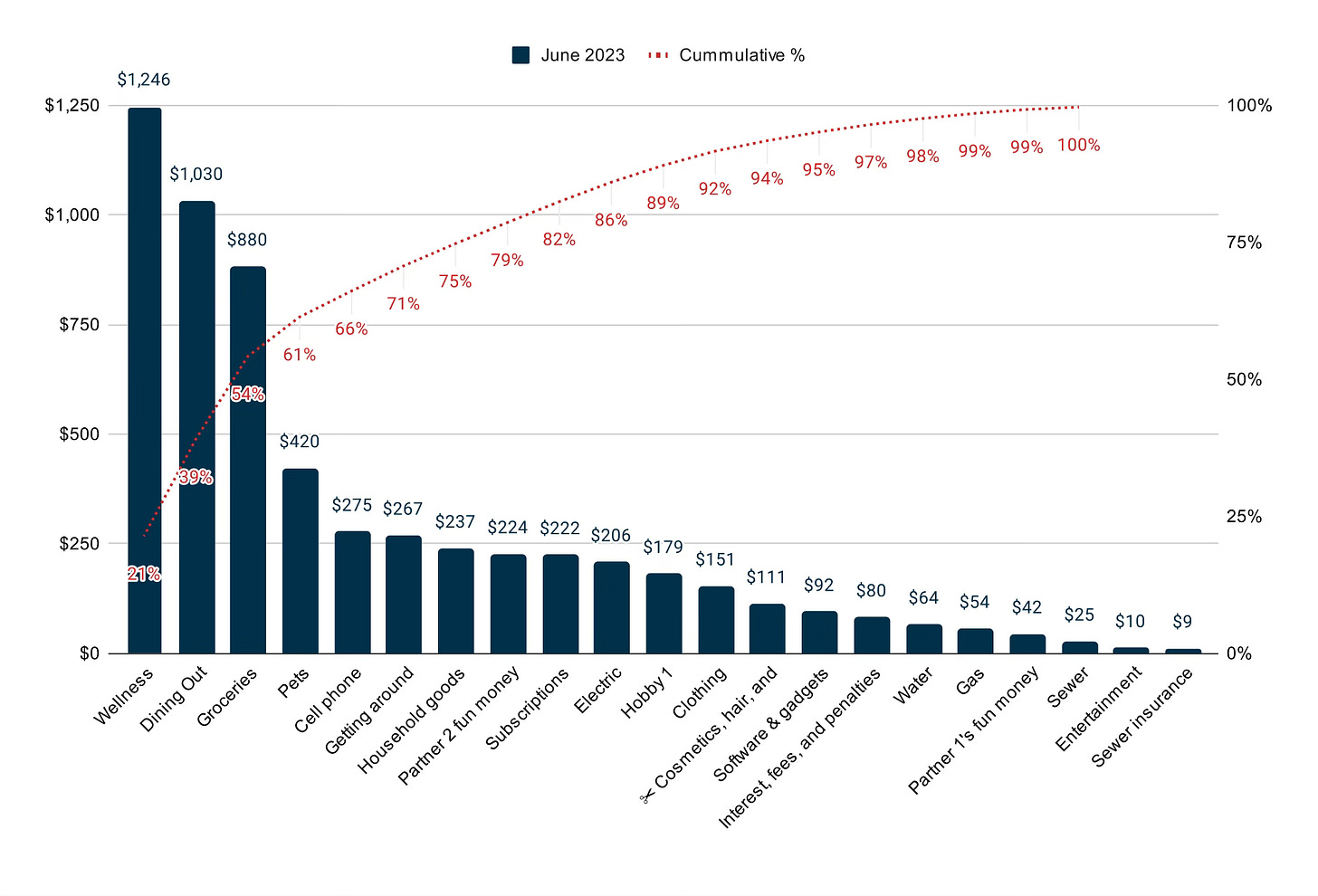

This is a super helpful visual that shows you the distribution and proportion of your spending in a single image. If a pie chart and a histogram had a baby, it would be a Pareto chart.

In the example above (dummy data) you can easily see that three categories make up the lion’s share (54%) of the monthly spending.

Pareto charts are used regularly in business to figure out where are the most impactful opportunities to make changes. I was creating them all the time at work and decided to apply them to my personal finances.

Once you see your monthly spending broken down this way, you can make smart and nuanced choices about how to adjust things with an eye toward maintaining your sanity.

If your overall spending is too high, rather than trying to completely cut the tallest bars to zero (as I did in my all-or-nothing approach), you can instead play with the whole picture.

This level of granularity allows you to confidently increase spending in one area to offset a bigger reduction in another.

For instance, adding $100 to groceries to buy fancy steaks is absolutely worth it if it offsets a $250 dinner at a fancy steakhouse. Cutting out the $179 spent on your hobby is a bad idea if the void it leaves causes you to increase your Entertainment spending by more.

Thoughtfully and carefully increasing spending in certain areas to achieve an overall reduction was equivalent to adding walk breaks to my training runs.

Putting you back in control

The magic of the Pareto chart comes from its precision and context. By seeing how all of the knobs and levers work together, it becomes possible to make fine adjustments that preserve your quality of life and, importantly, keep your confidence high.

This is especially important when you’re dealing with a timeframe that’s longer than a month or two. The longer things take, the more important it is to feel good along the way.

Equipped with this new approach, you’ll be amazed how creative you can get with a set of well-informed constraints. I didn’t use to care much for ice cream, but I began to love it once I made it my reward for eating at home five days in a row.

Getting started

To make things easy for you, I’ve done the work and created a free Pareto Chart Calculator that only takes a few minutes to set up. Here are the steps to follow to get started:

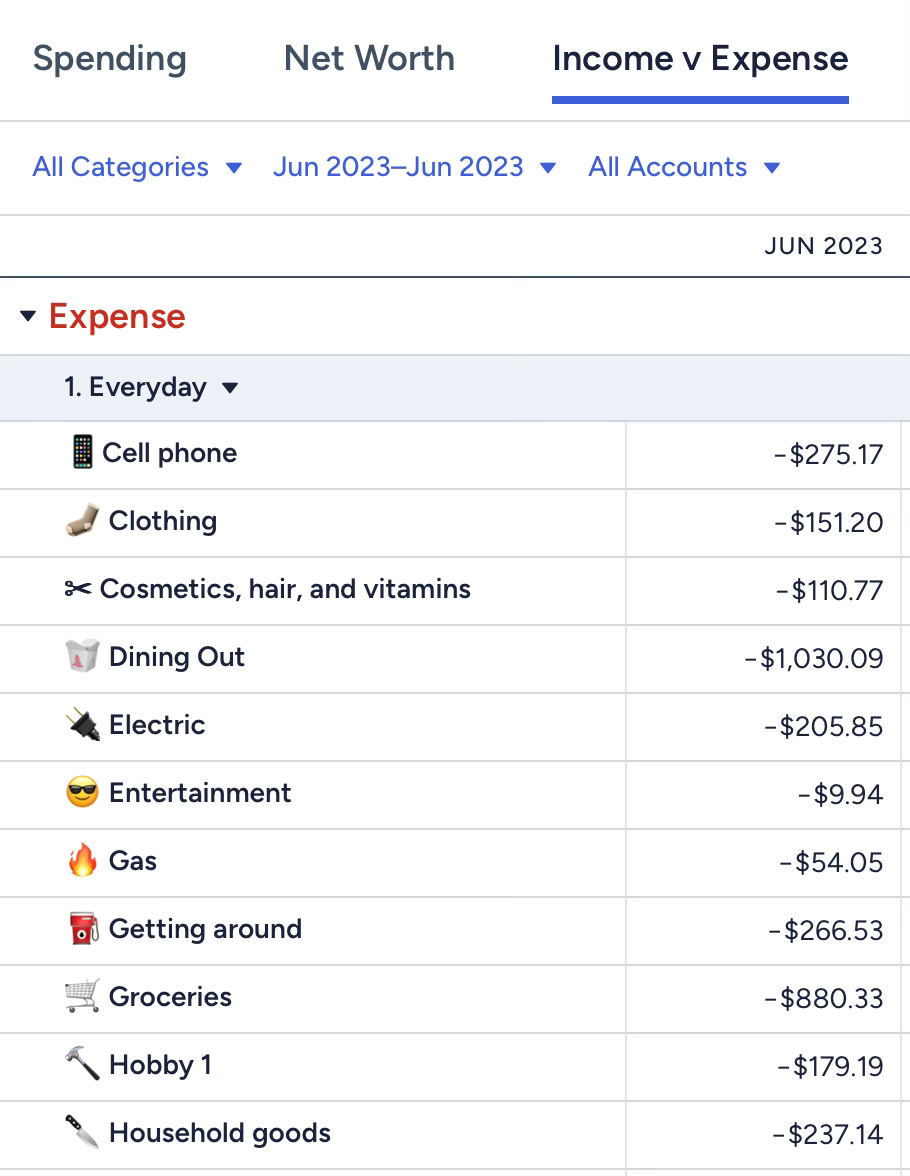

Pull a report from your budget showing last month’s spending for the categories you’d like to look into. In YNAB, my budgeting app of choice, this comes from the Income vs. Expense report.

Pro tip: Pareto charts work extremely well for the Everyday Spending standard budget category group. I highly recommend organizing your budget using this structure to make it easy to see what’s happening (and what will happen) with your finances.

Enter these categories and dollar amounts into the Pareto Chart Calculator. Your Pareto chart will be created instantly.

Review the chart, and identify the categories that make up the bulk of your spending. There will only be a few, and that's where you'll focus.

Pick a meaningful overall spending target, and identify which bars to raise and lower to get you there. Find ways to add sugar to the medicine. Where can you modestly increase spending?

Track your efforts. Next month, review the Pareto chart again, and confirm that your spending levels did indeed go down.

If they did, congrats! You’re doing it! If not, don’t sweat it. This is normal. It takes a few months to get the hang of things and remember, you’re not in a rush.

Crossing the finish line

I eventually did end up completing a couple of marathons, and in hindsight, the key to success was counterintuitive.

I had to learn to be patient and kind to myself. I had to realize that going slowly and feeling good was the fastest way to actually get to the finish line.

It was even easier with my finances. Once I found a way to reduce my spending in a sustainable way, I was finally able to stick with it for a long time, and that’s when I started to see results roll in.

Most importantly though, I was doing it in a way that didn’t feel awful. Win-win.

Love the point you make about 'no pain no gain' which, having read your piece, sounds totally counterproductive when thinking about playing the long-game.