There’s a right way to pay down debt

When keeping the status quo is the right call

Regardless of how deep in the hole you are, the ways out always look the same. There’s a fast path, and a slow path.

I like to think of it like scaling a mountain. The faster path is more strenuous but gets you to the top sooner. The slower path isn’t as taxing, but covers more ground and takes longer.

The slow path is the default. It’s how we all behave. As you pay off each debt, the money that used to go toward its minimum payment now gets to return to enriching your lifestyle. All of a sudden there’s more money each month for dinners out, buying toys, and taking trips.

The fast path requires that you continue to live as though all your debt is frozen in time until the very last cent is paid off. Instead of spending the $200 that used to go to an old debt on fun things, you instead direct that money toward paying down another debt.

The good news is that inertia is on your side. All those minimum payments are already here and accounted for, and assuming you’re not adding more debt, your lifestyle already fits within the money left over. So taking the fast path just means not “giving yourself a raise” and increasing your spending as debts go away.

The fast path is fast

The difference between the fast and slow path is profound. To illustrate, I’ve constructed a fictitious debt load from two very real loans that belong to a friend.

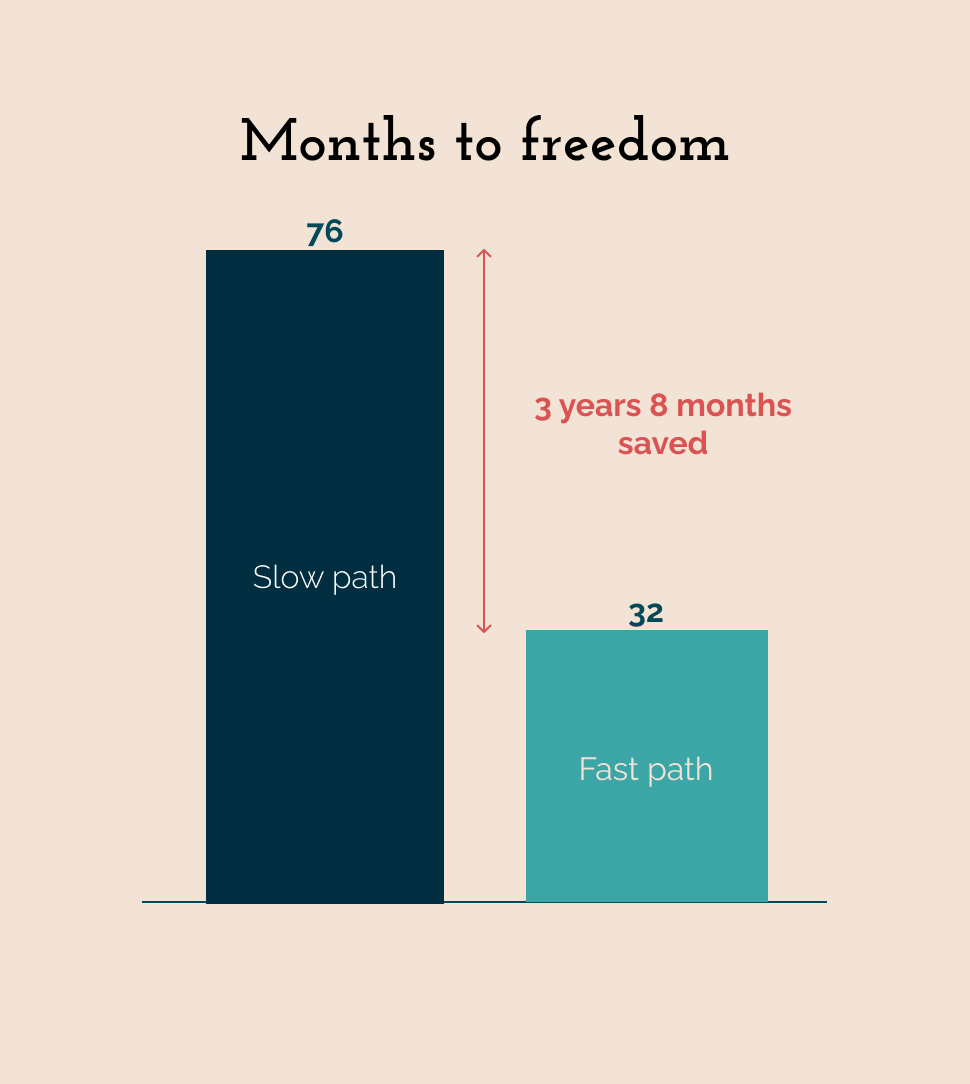

The slow path pays the debt off in 6 years and 4 months (76 months).

The fast path knocks the debt out in a head-turning 2 years and 8 months (32 months). That’s half the time!

In addition to the time saved, you’ll also keep the $4,548 that would have otherwise gone to your creditors.

The price you pay for going fast however is that you have to continue paying the full $342 to your creditors for the entirety of the 2 years and 8 months the fast path takes.

How does going fast work?

To understand why the fast path works, it’s helpful to understand the mechanics of a monthly debt payment.

Paying off debt through minimum payments is akin to taking one step back and a slightly larger step forward.

Let’s look at that Citibank credit card payment.

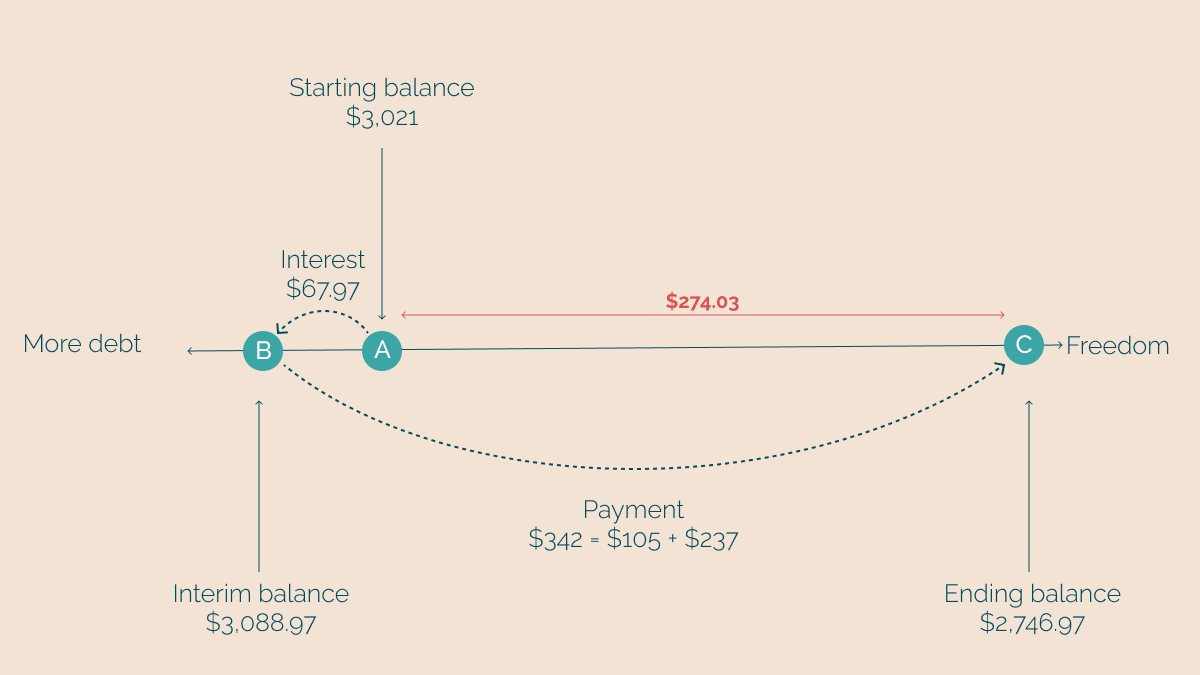

The number line below illustrates our progress toward paying off this debt, which I call “freedom.” The further we are to the right, the closer we are to paying off the debt.

Paying the toll

When you make a payment, the very first thing that happens is that Citibank takes their money in the form of interest. That’s represented by the jump from circle A to circle B below.

The interest charged comes from multiplying the starting balance of $3,021 by the Annual Percentage Rate (APR) of 27%, then dividing by 12 to get the monthly interest charged.

Here’s the calculation: ($3,021 x 27%) ÷ 12 = $67.97

Your balance then increases by $67.97, resulting in your interim balance, represented by circle B. Because the balance owed got bigger, it represents a step backward on the journey toward freedom.

Making progress

Only after giving your creditor their pound of flesh do you finally get to make progress toward getting out of the hole. That’s represented by the jump from circle B to circle C below.

The minimum payment of $105 takes us from the interim balance (circle B) to the ending balance (circle C).

Here’s the calculation : $3,088.97 (interim balance) - $105 (minimum payment) = $2,983.97 (ending balance)

So after all is said and done, your $105 payment only lowered your total amount owed by $37.03 (shown in red).

That’s a lot of effort for very little gain. It’s the financial equivalent of trying to sprint under water. If you’ve ever wondered why your minimum payments hardly make a dent in your balance owed, this is why.

When you only ever pay the minimum payments on a set of debts, this is what’s happening for each one. You’re basically pushing against a strong headwind over the life of each and every loan, which is what makes the slow path slow.

The fast path

The opportunity to jump on the fast path presents itself once you pay off your first debt. In this case, the money that used to go toward that debt’s minimum payment now gets rolled into the payment of a remaining debt.

Let’s see it in action.

Pretend that the Discover Credit Card debt was just extinguished last month. Because this is the fast path, rather than spending the Discover loan’s $237 minimum payment on fun and goodies this month, you instead apply it to Citibank’s minimum payment.

The jump from circle A to B is the same since the starting balance and interest charged aren’t affected.

The magic happens in the jump from circle B to C. Here, the entirety of that old Discover payment is applied to the Interim balance, resulting in a much lower ending balance for the month.

After all is said and done, we end up bounding toward freedom to the tune of $274.03. Compared to the paltry $37.03 resulting from the minimum payment alone, that’s a huge gain. Not bad for leaving your lifestyle unchanged.

You don’t have to wait to get started

In the examples above, you’ll notice that I said that the fast path only gets fast when you pay off your first debt. While that’s true, you can shortcut the system by simply adding additional money to a debt’s minimum payment in general. It doesn’t have to come from the minimum payment of recently extinguished debt.

The two most popular methods for taking the fast path are the debt snowball and the debt avalanche. The choice of which to take is a subject for another post, but just know there are lots of online calculators and apps available to help you game out the options.

Whether this additional monthly cash comes from lowering your monthly expenses, or pulling in some extra cash from a side hustle, once that extra money gets added to a minimum payment, you’re on the fast path.

You can control how quickly you get out of debt by adjusting how much extra cash you kick into paying down the debt load every month.

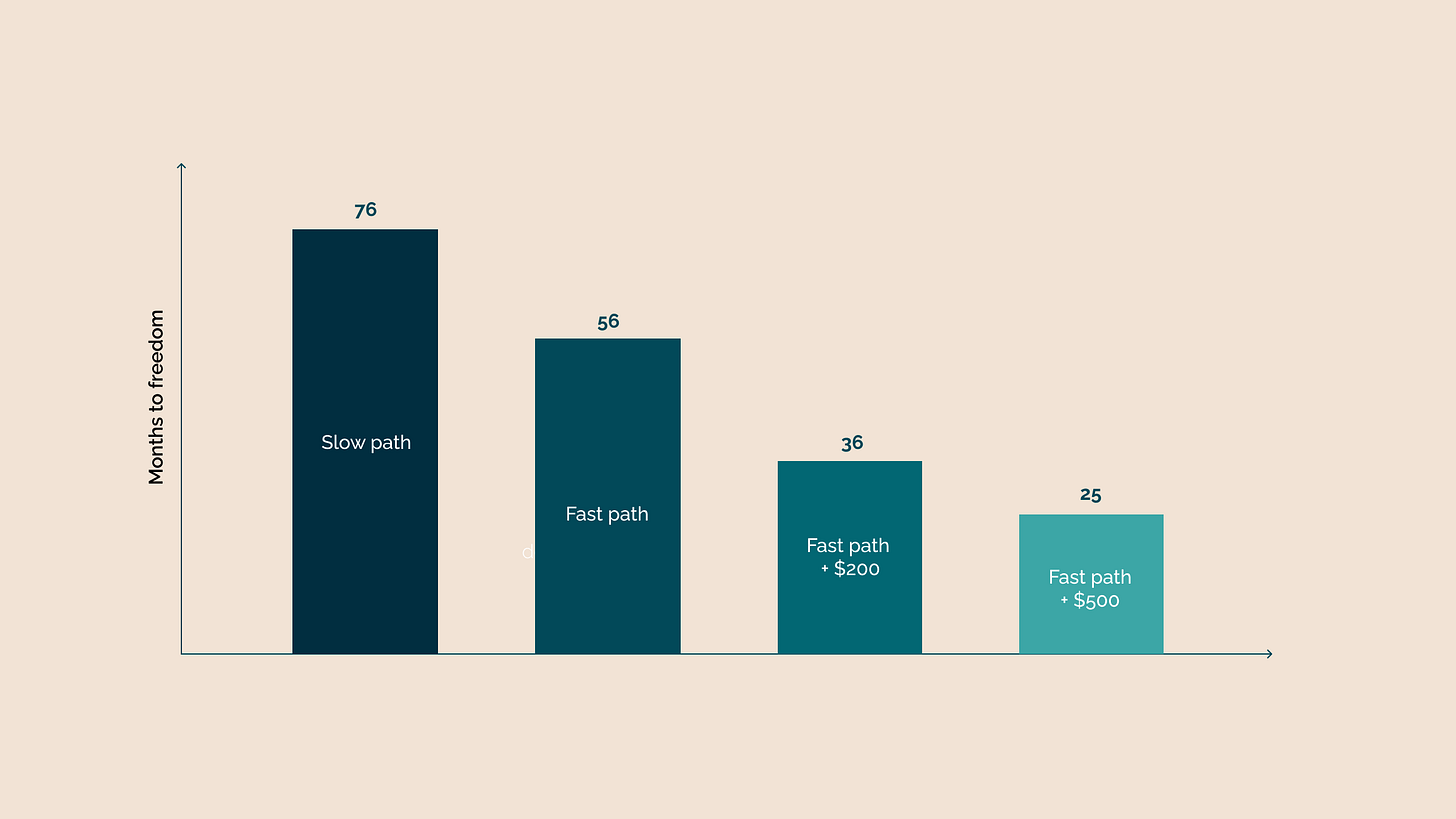

As we touched on earlier, the slow path gets you out in 76 months.

The fast path opens up when the Discover debt is paid off, which is scheduled to happen in month 11. Rolling the Discover minimum payment into the Citibank payment gets you out of debt in 56 months.

If you didn’t want to wait however, and found an additional $200 to pay into the system, you could be out in 36 months. If you’re really eager, kicking in an additional $500 a month catapults you to freedom in just over 2 years time (25 months).

Closing thoughts

Being in debt sucks. No one likes watching minimum payments leech their hard earned dollars. But once you get used to the living within the smaller lifestyle left over, you can use that comfort to your advantage.

By voluntarily living within that small but familiar space, you can proactively put yourself on a smarter and more efficient path toward freedom. Once you’re out, that’s when you give yourself that massive raise and enjoy the fruits of your hard work.

They say there’s no such thing as something for nothing, but in this one case, you can actually get a lot for not changing anything about your lifestyle at all.

This is what should be taught in schools! We'd all be in better financial shape if we had this knowledge explained as well as this article. I'm saving all your articles for future reference and sharing them when someone runs into this situations.

Also loving the visuals! They add so much clarity. Keep 'em coming Jon

I love these graphics Jon!