You don't need more pay to get get a raise

How to reveal a new dimension for compromise

My friend was concerned. Earlier that week, she had picked up on the not so subtle hint that the promotion she was expecting wasn't likely going to come with a meaningful increase in pay.

Her boss wanted to give her a proper raise, but the company was underperforming financially, and there just wasn’t the cash to do so. She was disappointedly resigned to the fact that she would likely see an increase in responsibility without a matching increase in salary.

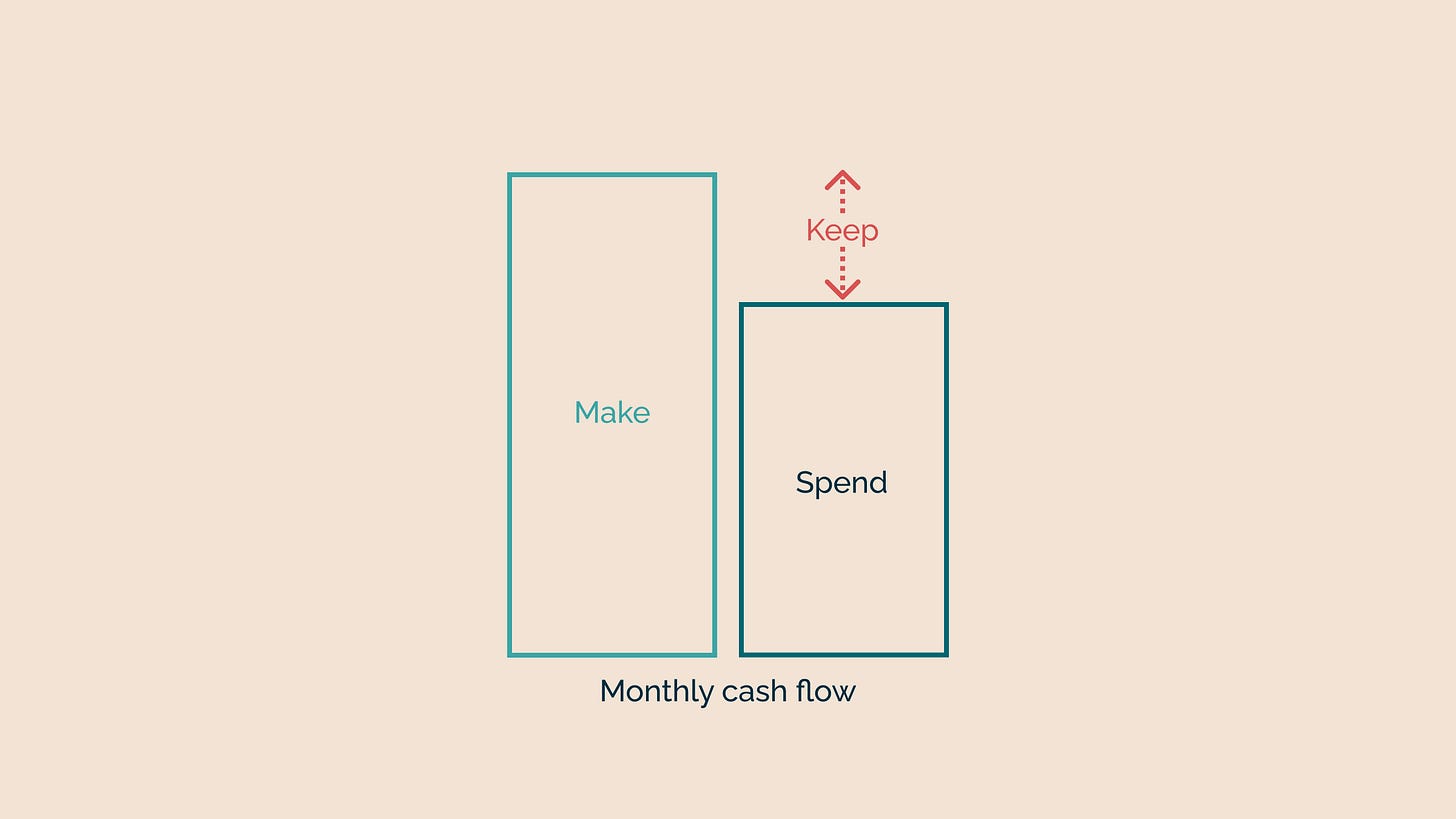

What you make is important, but what you keep is all that matters. Viewing her situation through that lens, I noticed a way to thread the needle.

Her daily commute consisted of getting on a bus at 6:00am and battling through two hours of morning traffic to get to her office. At 5pm, she’d do the whole thing in reverse. She did this five days a week for years. The daily round trip bus fare was $14, which works out to about $300 a month, on average. What if she could strike an agreement to work two days a week from home?

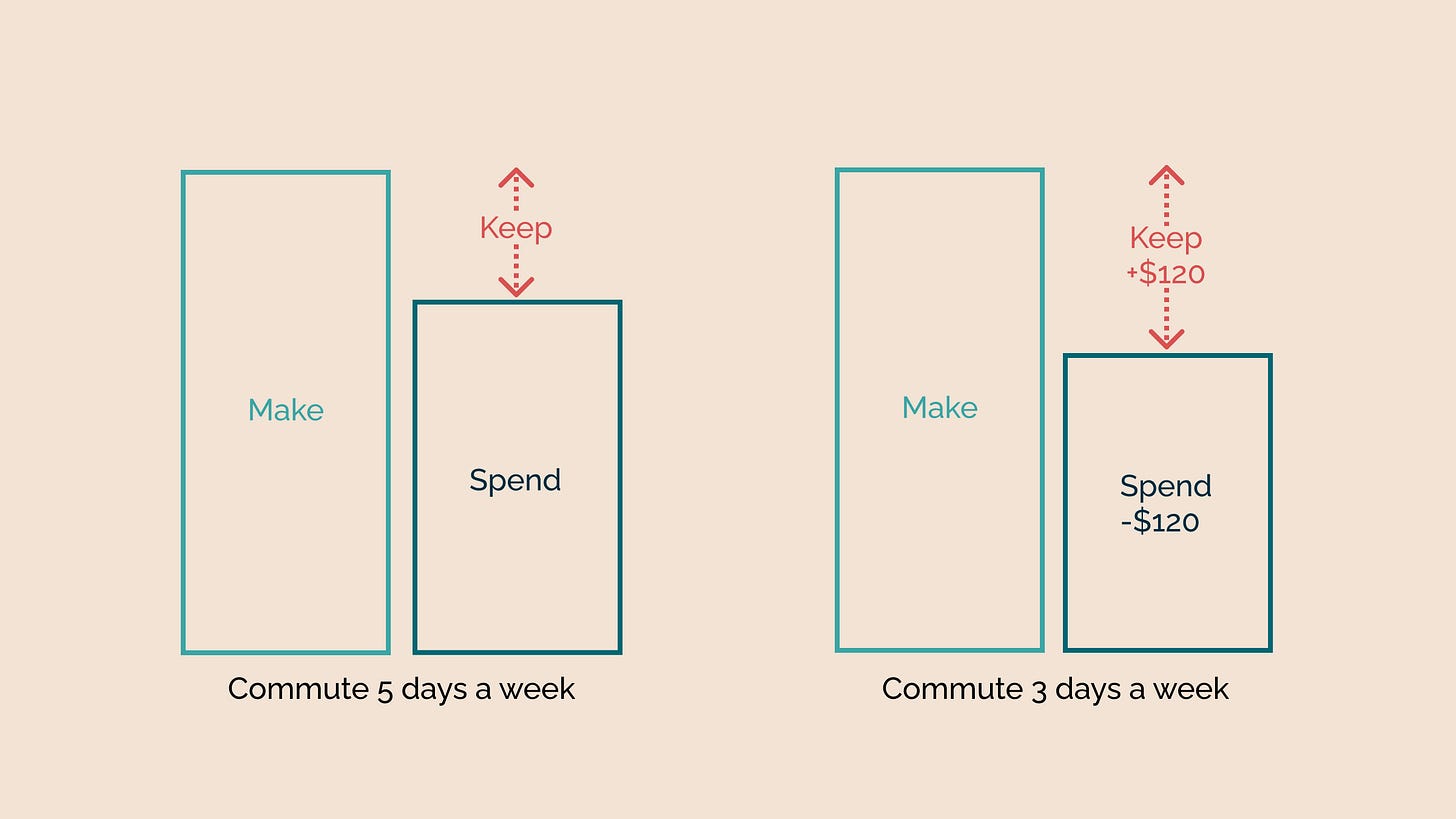

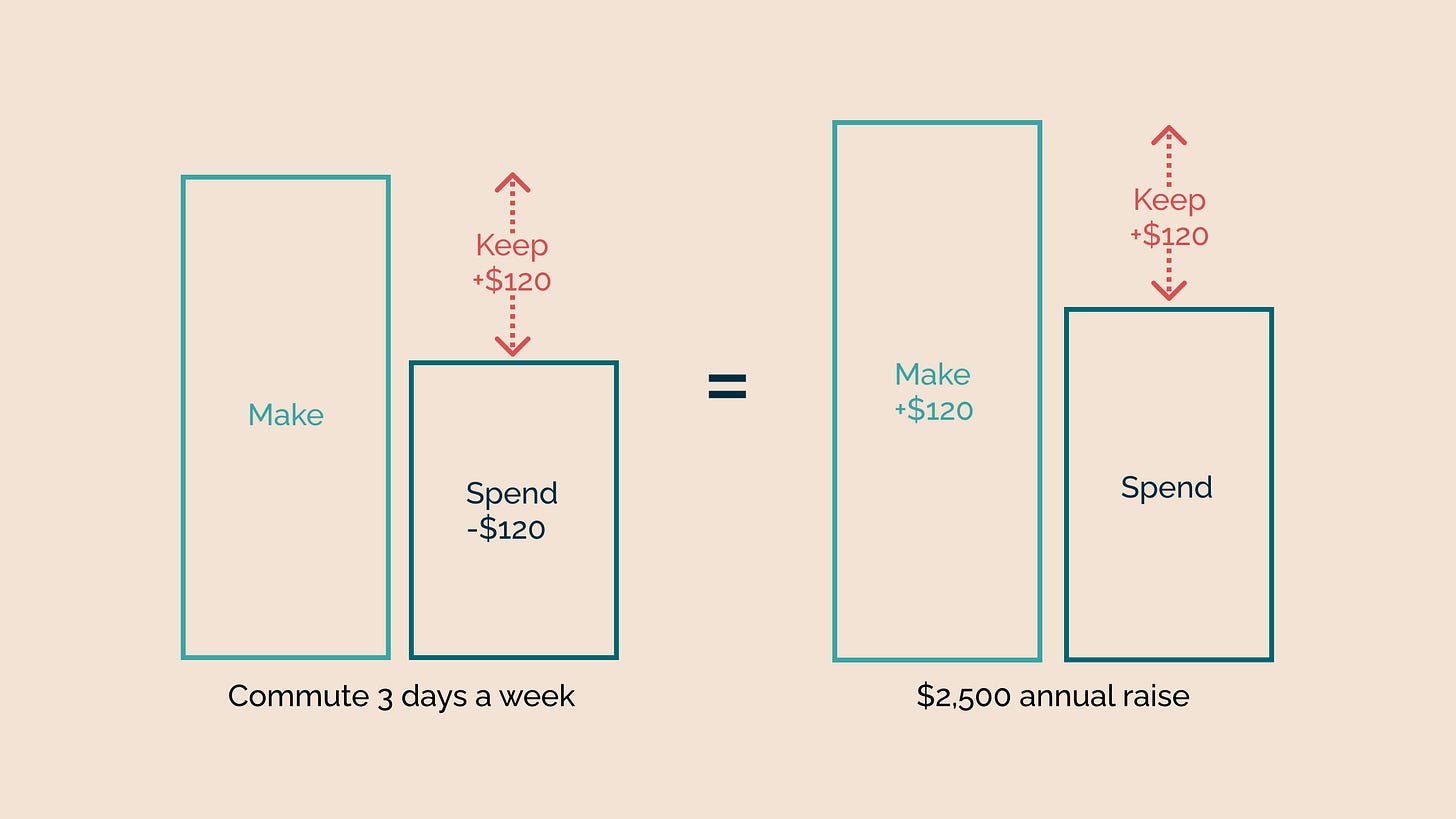

This was long before the pandemic, and working from home wasn't normal for her company's culture. Cutting her weekly commute down from five days a week to three would result in slashing her monthly bus expense from $300 to $180. Those savings would lower her monthly spending by $120, thereby increasing what she kept by $120.

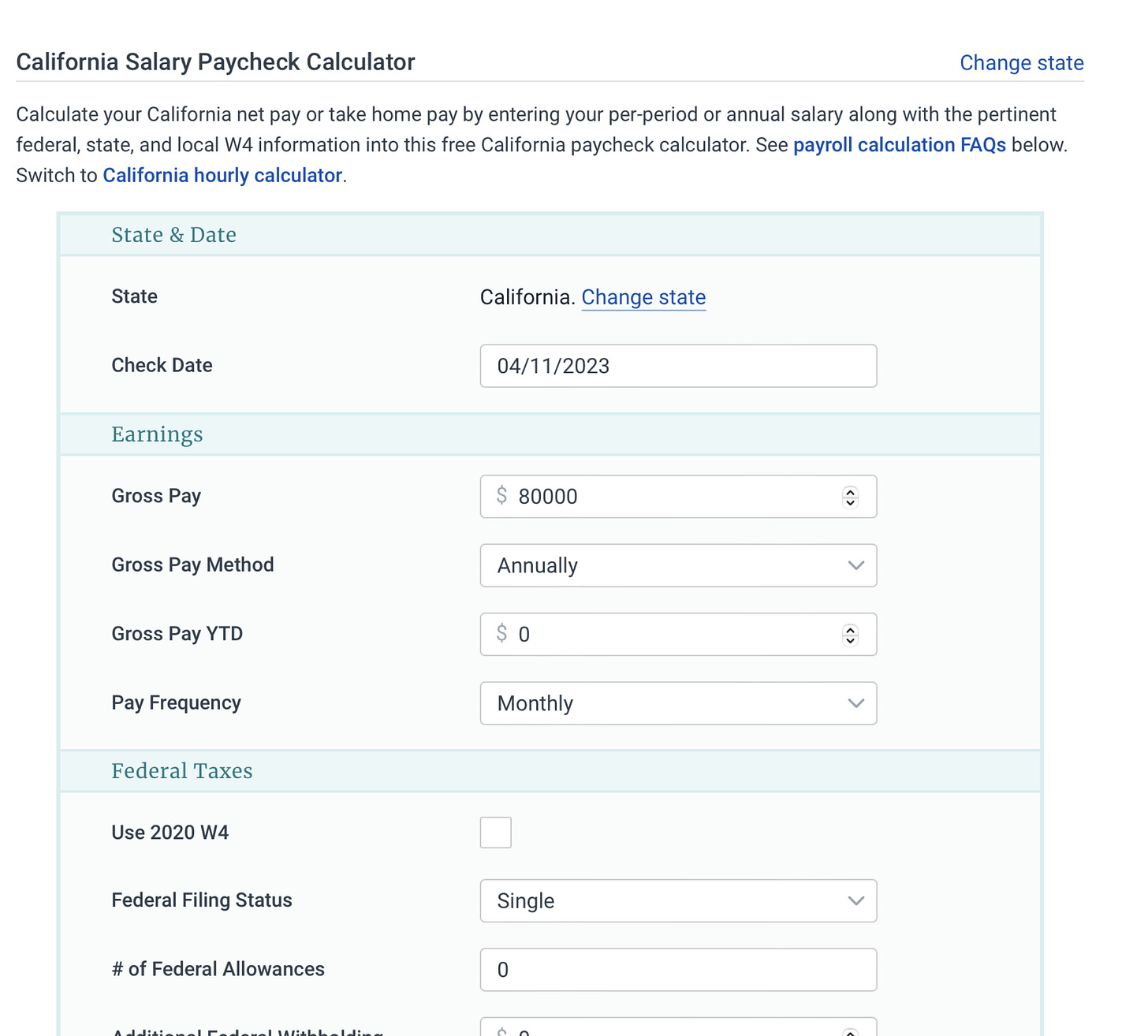

How much of a raise would she have to get to put an additional $120 post tax dollars in her pocket every month? To figure this out, I went to one of the many online paycheck calculators and keyed in her annual salary and tax information to get a baseline.

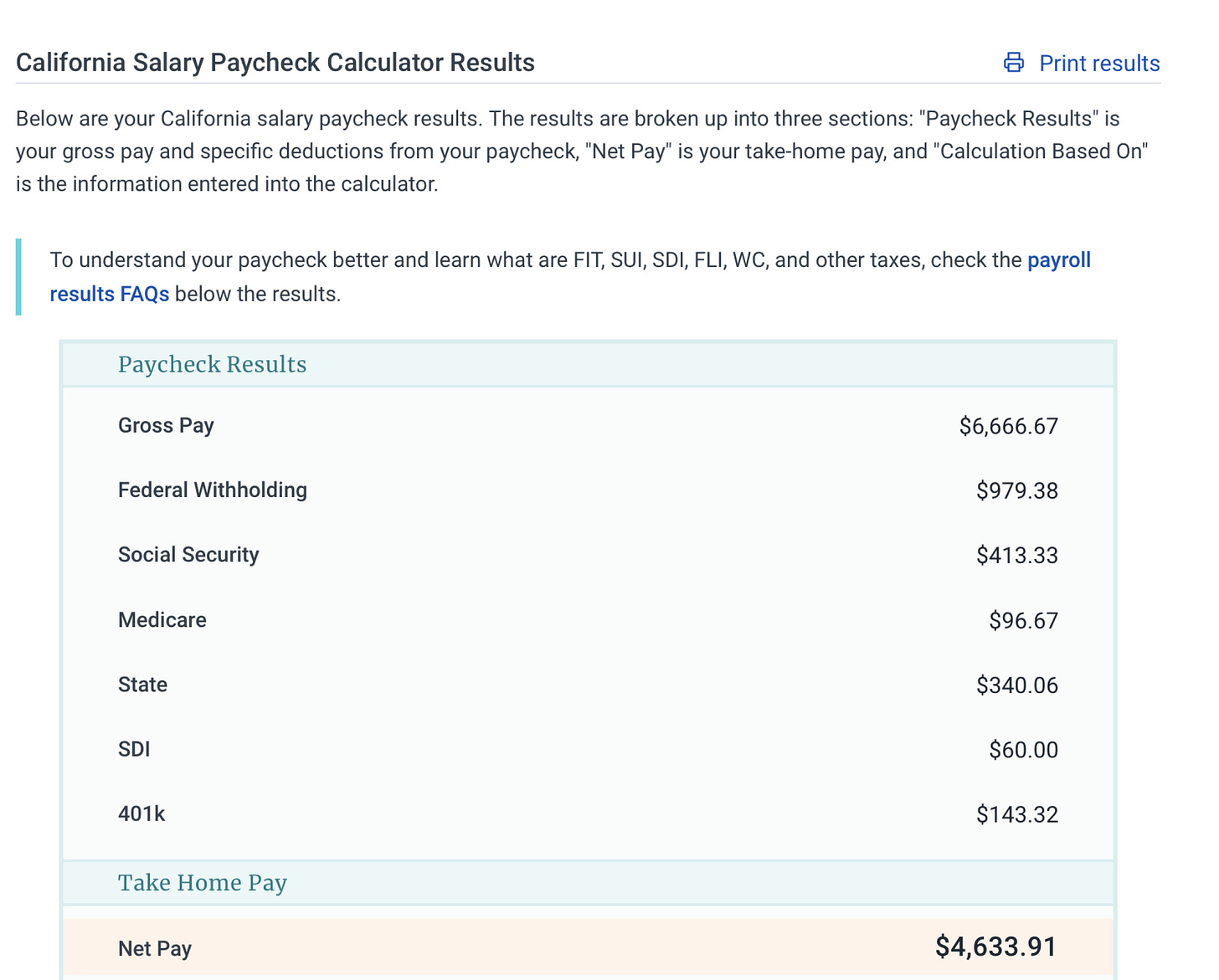

At the time, she was making about $80,000 a year and contributing to her 401k. I filled in the fields and confirmed that the results matched her real paycheck.

Next, I redid the calculation for $500 increments of additional salary to see how her paycheck was affected. I logged the results in the table below. As you can see, after taxes and deductions, every $500 dollars of additional salary resulted in a $24 bump in her monthly paycheck.

The last row of this table shows that a $120 bump in monthly net pay equates to a $2,500 increase to her annual salary.

In terms of what she kept every month, the savings in post tax dollars that would come from reducing her commute was equivalent to a $2,500 raise in gross pay.

After showing her the math, her spirits lifted. She realized that even if the company didn't have the cash to pay her what it wanted to, the reduction in her commuting costs offered a non-cash way for the company to make up the difference. She ended up striking the deal with her employer, and it was a true win-win.

The new arrangement not only meaningfully improved her financial position, but also allowed her to reclaim about 8 hours a week that used to go to commuting. It was like getting an extra day off. Framing her salary negotiation in terms of what she kept, instead of only what she made, revealed a wise compromise that might have otherwise gone unnoticed.

Great reframing Jon! This is lateral thinking, I would never thought this approach with yield the same benefits. Great lesson to draw that there's always another way!

This is such a helpful reframe and one I want to adopt! There’s a certain point where more money (though nice) isn’t necessarily the solution we actually want. And I like the creative way you found more money without actually needing a raise. Particularly helpful to keep in mind in the current job market!