The joy of guiltless spending

Prepay your big expenses by treating them as bills

I don’t know about you, but when it comes to my spending, when it rains, it pours. Hindsight makes it easy to get a clear picture of my financial health. All I have to do is compare my average monthly spending to my average monthly income. The problem is that in any given month, my spending rarely looks like the average. Some months are super spendy and others are comparatively spartan. This unevenness of spending creates a structural trap that easily snags most of us.

Take March for example. Three looming large expenses conspired with one another to hit me all at once: A bachelor party for my cousin required booking a long weekend stay in Nashville, major dental work suddenly couldn’t wait any longer, and of course, this happened to be one of the rare years where I owed taxes. Taken together, these three expenses shot my monthly spending for March well above my 12-month average.

When a large purchase has to be made, we often end up having to borrow to cover the difference. A drop in your savings account balance or a spike in your debt balances serves as evidence of falling into the trap.

Luckily, it doesn’t have to be this way. You can set up systems that not only neutralize the anxiety and stress that often come with these large expenditures, but also make spending the money fun. The key is to anticipate these expenses and pay them off in advance.

Treat big expenses as bills

Everyone has a set of large expenses that they can see coming. The moment my cousin asked me to be his best man, I knew that at a minimum I’d have to pay for destination trips for his bachelor party and the wedding itself. Rather than borrowing money and paying it back over several months with interest, why not start paying for things now and skip the interest altogether?

I put a price on the whole trip by drawing up an estimate of expenses. Airfare, lodging, car rental, wedding gift, dinners out, day trips, the bachelor party, etc. All in, I estimated this wedding to cost me roughly $7,000. While that’s a big number, I had seven months of lead time to prepare for it.

Dividing the $7,000 into seven monthly installments allowed me to treat the expense like a $1,000 monthly bill. I use a popular budgeting software called YNAB that allows me to create virtual accounts that I can fund for specific purposes. Each month, “paying” my $1,000 monthly “bill” resulted in a $1,000 deposit into my Cousin Wedding virtual account. Just like paying a real bill, each $1,000 ‘payment’ was treated as if it left my checking account, unable to be used for other expenses and effectively tightening my budget for those 7 months.

As time went by and expenses came up, like booking an AirB&B for the bachelor party, I’d simply draw funds from the steadily growing Cousin Wedding virtual account. Since I had already parted with those dollars months ago, making the actual purchases was just a matter of sending those “spent” dollars to their final resting places. When I go to Nashville in a couple of weeks, I’ll happily spend money painting the town red because I’m effectively playing with house money. There’s nothing sweeter than spending a pile of money for the purpose it was set aside for.

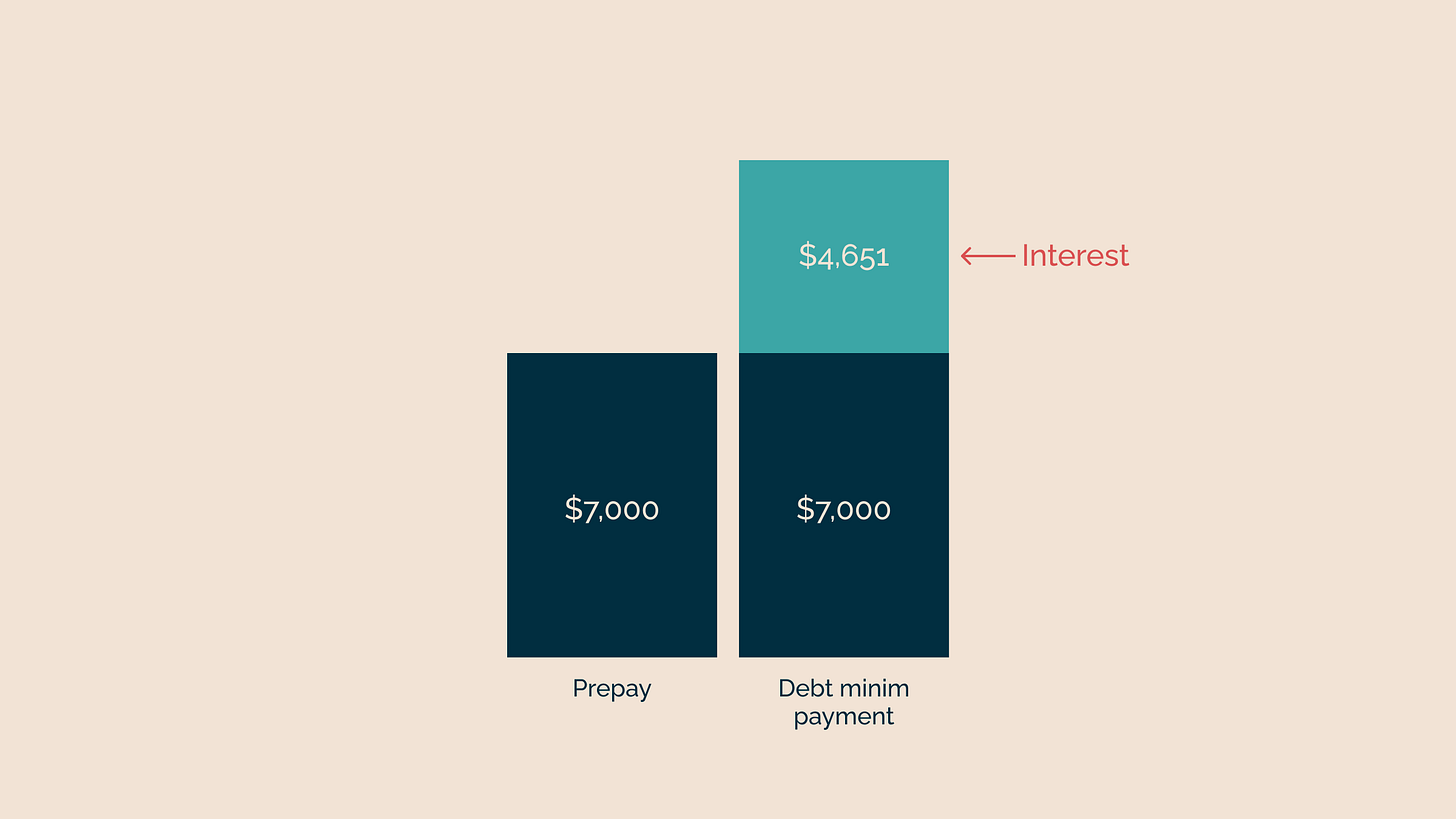

By contrast, if I were to borrow from a credit card, I’d have to pay interest. The image below shows the best case, but very unlikely scenario where I pay off the debt in the same seven month timeframe, after making purchases. To keep things simple, assuming I spent all $7,000 in month 7, paying it all back in seven months would require paying an additional $110 a month in interest for six months, then paying off the remaining $900 balance in month 14.1

In this very rosy scenario, I’d have spent an extra $560 in interest over the following seven months, compared with paying $0 in interest over the seven months leading up to the event. In reality, most people would put all $7,000 on the credit card and simply make minimum payments until the balance was cleared. I’ve written before about how painful this path is. In this more than likely scenario, it would take 4 years and 8 months to pay off the $7,000 balance, and you’d wind up paying $4,650 in interest. Ouch.

By treating these foreseeable large expenses as monthly bills, I’m choosing to sacrifice in the short term so that I can indulge and let loose later. The short term sacrifice also allows me to keep my savings intact and ensures that I don’t pay a cent in interest.

I now treat all my large expenses this way. While last month’s outlay of cash was significant, none of it was stressful since each payment was drawn from a dedicated account in YNAB, filled with dollars I parted with months earlier. The dollars leaving my checking account were a mere formality, and I was able to keep on living without breaking stride.

Great piece! Love the honest no nonsense way in which you tackle the big life stuff that somehow we are all just required to figure out. I second Oscar, lovely visual aids.

Have a great time in Nashville!

Amazing Jon! This is another example of advice that should be taught at school. SO important. I will do this the next time I travel, it definitely would've saved me some money on past trips. It speaks to consistency, planning for the future and taking away anxiety and bad decisions.

Also, I love how you paired it with the visuals, starting with the monthly spending, it becomes so much easier to visualize and remember.

PS. Have lots of guilty-free fun at the bachelor party!