You’re not spending enough

Don’t be a fool. Track that accrual.

It took me a long time to realize that in order to worry less about money, I had to spend more.

If we even think about this at all, we often compare our spending to our income. Spend more than we made in a given month, and we know we overdid it and need to cut back next month. If we spend less than we made, then we proudly pat ourselves on the back and celebrate with an extra night of eating out. While this line of thinking is sensible, it has a blindspot.

Many of our large expenses hit us infrequently, and if we’re not accruing for those expenses, we can easily delude ourselves into thinking we’re in better shape than we are.

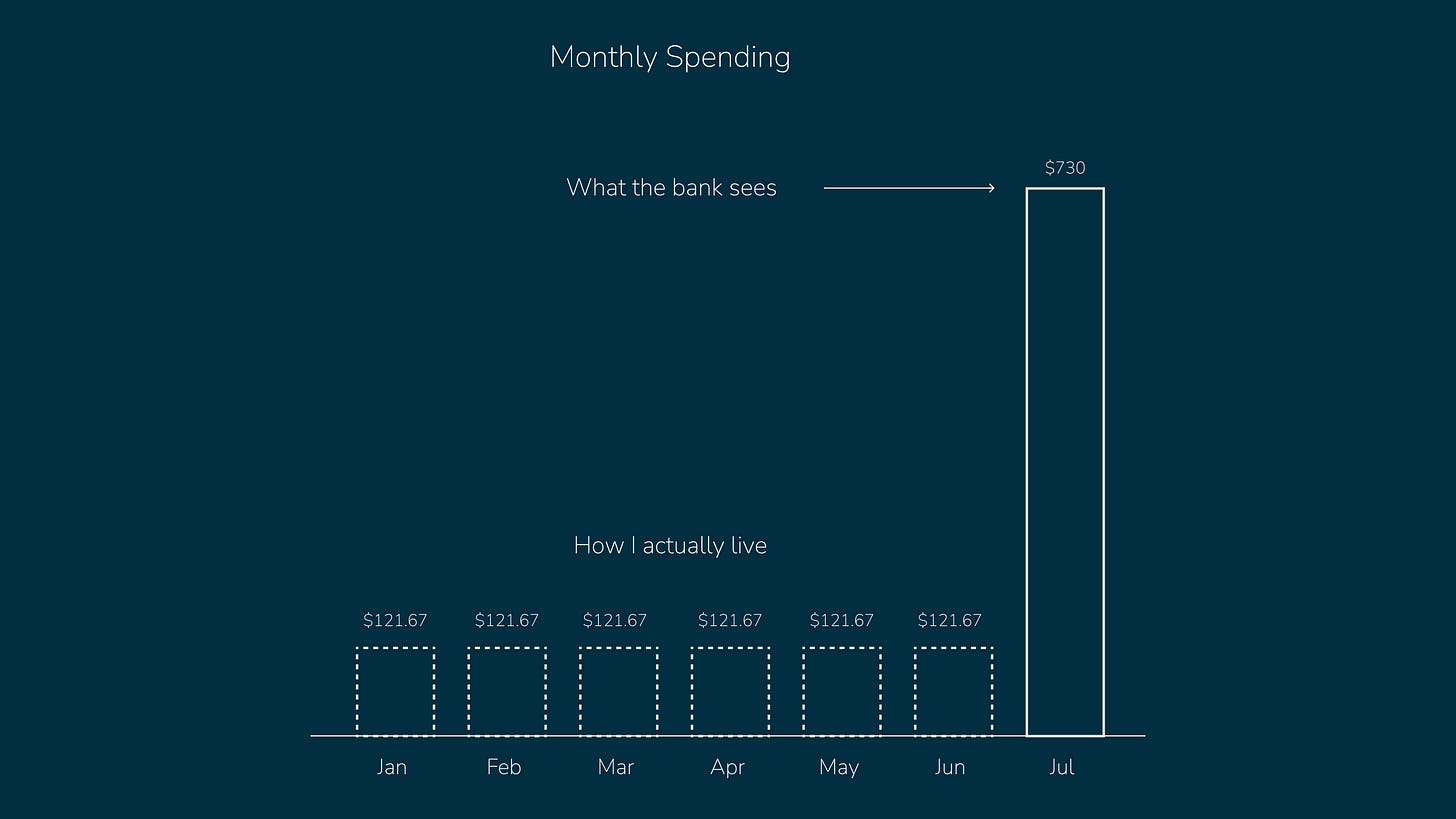

My car insurance payment is a perfect example of a large, infrequent expense. Every six months I have to make a $730 premium payment. I can see it coming, and I know how much it’ll be, but it’s easy to forget about and will shock me when it arrives. If I’m unprepared for it, at best I pull the payment from savings, at worst I have to put in on the credit card.

In my last post, I detailed the approach and tools I use to deconstruct that $730 semi-annual insurance payment into a “monthly bill” of $121.67. I use quotes because that “monthly bill” isn’t really a bill, but is actually an accrual.

When I “pay” that bill, dollars don’t actually leave my checking account, yet I live my life as if they do.

What I now call spending includes these accruals, and thinking in this way has dramatically lowered the stress and drama of my financial life. I’m not actually spending more over the course of the year, I’m just accounting for all of that eventual spending, every month.

Thinking in this way means that my monthly spending is greater than what the bank statement says, but it’s also more accurate since it’s representative of what I know is coming.

I think of these predictable expenses as scheduled obligations, and they show up in my monthly budget like any other group of bills. Here are a few of my current scheduled obligations and their monthly accruals:

Some of these accruals are small, others are fairly large, and altogether they add up to about $1,000 a month. In order to live within my means, I have to ensure that my total expenses, including these accruals, falls below my monthly income.

When I redefined my spending and started living in this more realistic way, big expenses stopped phasing me. Now that I’m confidently living within my means, I feel I can take on anything, and it’s more than worth it.

When is your book coming out? With each issue I feel like you teach and encapsulate one very powerful concept, that everyone should be familiar with, in very powerful and memorable ways.

It's liberating to think it that way, that you can, and should, spend more to make more 👌